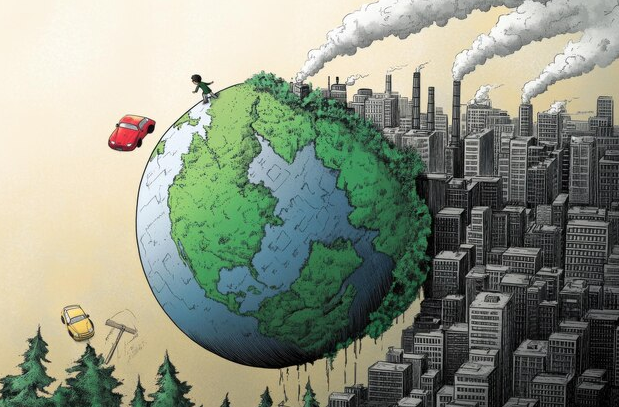

The impact of climate change on the US financial market is a pressing concern as we approach the year 2025. This phenomenon is altering weather patterns, impacting agriculture, and leading to natural disasters, all of which have significant repercussions on the economy.

As temperatures rise and sea levels increase, sectors like agriculture, insurance, and real estate must adapt to new realities. Companies navigating this transition successfully stand to gain competitive advantages. Meanwhile, investors are increasingly factoring environmental, social, and governance criteria into their decisions.

The changing landscape of risk

Climate-induced phenomena such as hurricanes, floods, droughts and wildfires are becoming more frequent, creating a volatile environment for the financial sector. Insurers, in particular, are feeling the strain as they are forced to reevaluate risk models and adjust premiums accordingly. This increased risk profile trickles down to other industries, affecting everything from real estate investments to stock prices.

For investors and financial institutions, recognizing and calculating these risks is paramount. Going forward, risk assessments will need to be comprehensive, incorporating climate-related threats as a fundamental component. Companies not aligned with this new approach may face significant financial pitfalls.

Insurance and real estate challenges

Insurance companies face the immediate challenge of adapting to a world where natural disasters can devastate properties and lives more frequently. This change requires the sector to adjust its underwriting practices, reassess policy costs, and introduce new products that can better handle climate-related risks. Failure to adapt can lead to severe financial losses and sector instability.

The real estate market, similarly, must contend with shifting landscapes. Coastal properties, once considered prime real estate, are now at the forefront of risk due to rising sea levels and increased storm activity. These pressures will lead to shifts in property values and new considerations for future investments.

Both industries must innovate to remain viable. The rise of green buildings and sustainable infrastructure presents opportunities for forward-thinking firms. Environmental resilience will become a key selling point and risk mitigation strategy.

Investment strategies in the face of climate change

With the impact of climate transformation on the financial markets, investment strategies are evolving. A growing number of investors are considering environmental, social, and governance (ESG) factors when making decisions. This shift is leading to increased capital flow towards companies that prioritize sustainability and demonstrate robust climate strategies.

Green bonds, sustainable fund offerings, and climate-focused ETFs are becoming more prevalent. These financial instruments allow investors to align their portfolios with their values, supporting businesses committed to reducing their carbon footprint. As awareness and concern grow, ESG-focused investments are expected to become mainstream by 2025.

Moreover, businesses are incentivized to present transparent and accountable sustainability reports. Those that fail to act responsibly may face divestment and reputational damage, highlighting the importance of proactive climate strategies.

Policy and regulatory implications

Government policies and regulations are increasingly reflecting the need to address climate changes in financial markets. As the public demands stronger action on climate, policymakers are implementing regulations that encourage sustainable practices. These actions not only aim to curb environmental damage but also provide a stable environment for economic growth.

Policymakers are likely to introduce more stringent carbon pricing mechanisms and incentives for renewable energy development. The financial market must be prepared for regulatory shifts that will impact corporate accountability and sector performance. By factoring in these changes, firms can mitigate risks and capitalize on new opportunities.

Carbon pricing and its market impact

Implementing carbon pricing mechanisms, such as taxes or cap-and-trade systems, could play a significant role in the US financial landscape by 2025. These measures make it costly for companies to emit greenhouse gases, encouraging them to invest in cleaner technologies and sustainable practices. The impact of such pricing on industries still reliant on fossil fuels will be profound, pushing them to innovate or face financial decline.

For the financial markets, this transition presents both challenges and opportunities. Companies that can adapt swiftly to lower emissions will likely gain investor confidence and market value. On the other hand, those unable to comply with new regulations may see a decrease in investment and market relevance.

Support for sustainable innovation

As regulatory bodies push for a greener economy, financial incentives for sustainable innovation will become increasingly prominent. Governments may offer tax breaks, subsidies, and grants to companies investing in renewable energy, energy-efficient technologies, and sustainable infrastructure development.

By 2025, these incentives will likely drive significant advancements in clean technology and green initiatives. They present an immense opportunity for investors and corporations willing to embrace change and focus on sustainable growth. This shift will not only aid in addressing environmental concerns but also drive economic sustainability and job creation in new sectors.